In addition to the protection of pension rights, the agreements contain provisions to determine the correct legislation to be applied in situations where there might be dual responsibility for social security contributions: e.B. workers temporarily posted from Ireland to a country with which we have concluded a bilateral agreement, and vice versa. The provisions (which are different in the different agreements) ensure that these persons are subject to the legislation of a single country. For more information on this aspect, see the guidelines entitled “PrSI Special Collection System”. Prior to the agreement, workers, employers and the self-employed could, in certain circumstances, be required to pay social security taxes for the same work in the United States and Ireland. The agreements allow SSA to add up U.S. and foreign coverage credits only if the employee has at least six-quarters of U.S. coverage. Similarly, a person may need minimum coverage under the foreign system to obtain U.S. coverage credited to meet the eligibility criteria for foreign benefits. If you have worked in Ireland and one or more EU countries, your social security contributions from any EU country can be added to your Irish social security contributions to help you receive one of the social benefits listed below. For some payments (for example.

B jobseeker`s allowance, sickness benefit and maternity allowance), your last social security contribution must be paid in Ireland. The United Kingdom will join the European Union on 31 September. January 2020, with the Withdrawal Agreement approved and ratified by the United Kingdom and the European Union. It will be followed by a transitional period until at least 31 December 2020. During this period, all existing EU social security rules will continue to apply in the UK. This means that there is no change to the existing mutual social security schemes between Ireland and the UK. The exemption rule can apply regardless of whether the U.S. employer transfers an employee to work in a foreign branch or one of its foreign subsidiaries. However, for U.S. coverage to continue when a posted employee works for a foreign subsidiary, the U.S. employer must have entered into a Section 3121(l) agreement with the U.S.

Department of the Treasury regarding the foreign subsidiary. My question is whether the contributions I have made during my five years working in Ireland can be added to my Social Security contributions here in the United States. The Ministry of Social Protection then requests your social security contributions directly from the other Member State or the foreign institution. The United States has agreements with several countries, called tabulation agreements, to avoid double taxation of income in terms of social security taxes. These agreements should be considered in determining whether a foreigner is subject to U.S. Social Security/Medicare tax or whether a U.S. citizen or resident alien is subject to a foreign country`s social security taxes. If you have Social Security credits in the United States and Ireland, you may be eligible for benefits from one or both countries. If you meet all the basic system requirements of a country, you will receive regularly from that country. If you do not meet the basic requirements, the agreement can help you qualify for a benefit as described below. Bilateral agreements exist with countries such as the United States that cover areas such as pensions, which stipulate that you can apply for Irish benefits by filling out an SSA-2490 application form, which should be available at any social security office.

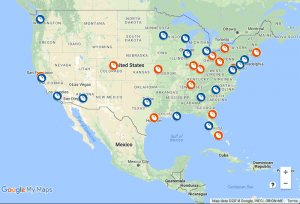

A common misconception about the U.S. agreements is that they allow dually insured workers or their employers to choose the system to which they will contribute. This is not the case. Nor do the agreements change the basic coverage provisions of the social security laws of the participating countries – such as those that define income or insured work. They exempt workers from coverage under the scheme of one country or another only if their work would otherwise fall under both schemes. When calculating your entitlement to an Irish social security payment under EU rules, all your eligible contributions from countries covered by the rules will be aggregated. They can be used with your Irish contributions to help you qualify for a payment. Since the late 1970s, the United States has established a network of bilateral social security agreements that coordinate the U.S. social security program with comparable programs in other countries.

This article gives a brief overview of the agreements and should be of particular interest to multinational companies and people working abroad during their careers. Ireland`s bilateral agreement with the United States dates back to 1993. I`m looking at an explanation of the 2017 agreement released by the U.S. Social Security Administration. Bilateral social security agreements are of paramount importance for pensioners who retire in Ireland after working in one of the above-mentioned countries. If you have worked in more than one country with which Ireland has a bilateral social security agreement, your entitlement to an Irish social security payment will be assessed separately under each agreement. Contributions under different bilateral agreements cannot be combined, but must be calculated separately. The calculation that provides the highest amount is paid. Special conditions apply to persons with social security contributions paid before 1953. Applications must include the employer`s name and address in the U.S.

and other countries, the employee`s full name, place of birth and date of birth, citizenship, U.S. and foreign social security numbers, place and date of hire, and start and end dates of overseas deployment. (If the employee works for a foreign subsidiary of the U.S. company, the application must also state whether U.S. Social Security coverage has been agreed for the affiliate`s employees under Section 3121(l) of the Internal Revenue Code.) Self-employed persons must indicate their country of residence and the nature of their self-employment. When applying for certificates in accordance with the agreements with France and Japan, the employer (or self-employed person) must also indicate whether the employee and the accompanying family members have health insurance. Most agreements provide that a period of incapacity for work during his stay in the other country must be counted as if he were in Ireland for the purpose of determining the duration of the incapacity for work. Although not provided for in the Quebec Accord, the general principles of equal treatment must be understood as including this provision.

To apply for a social assistance payment, you must complete the correct application form and return it to the Ministry of Social Protection. The return address is printed on the application form. Most U.S. treaties eliminate double coverage of self-employment by assigning coverage to the employee`s country of residence. For example, under the agreement between the United States and Sweden, an independent dual-coverage U.S. citizen living in Sweden is only covered by the Swedish system and is excluded from U.S. coverage. In the case of agreements with Australia, Canada, the Republic of Korea, Quebec and the United States, the provision that the date of receipt of application documents is treated as the date of application for a corresponding claim for benefits in the other country is subject to the condition that the applicant provide information that the coverage periods were completed under the legislation of the other country.

Anyone who wants more information about the U.S. Social Security aggregation program – including details of the specific agreements in place – should write to the following address: Despite the fact that the agreements are intended to allocate Social Security coverage to the country where the employee has the most important ties, occasional unusual situations occur where the strict application of contractual rules leads to an anomaly or results. Unfair.. .