Yes. Short-term rental operators registered with the Washington State Department of Revenue are required to file returns during each assigned filing period, regardless of whether short-term rental income has been generated or short-term rental taxes have been collected. Such returns are commonly referred to as “zero dollar returns.” The main advantage of diversifying your portfolio is that you are able to offset the risk of losing money with only one type of investment. So if you`ve invested money elsewhere, like . B as in stocks, buying a rental property allows you to diversify your portfolio. A real estate forum is not the ideal place to research how to manage your client`s accounting. For tax reasons, short-term rentals in Washington State are defined as bookings of less than 30 days. In Washington State, everything the host requires of the guest to use the accommodation is considered part of the rental fee. These include items such as cleaning fees, pet fees, extra bed fees, extra person fees, etc.

Charges for additional services provided by the short-term rental operator, such as parking, meals or laundry, are also taxable. Failure to comply with national and local tax laws may result in fines and interest penalties. These may not catch up with short-term vacation rental operators, but the sharing economy is under increased scrutiny, so it`s important to consider compliance before tax authorities take care of it for you. Although income generated directly from the rental of non-temporary real estate (i.e. in the long term) are exempt from B&O tax, other additional sources of income from the rental of rental properties may be subject to the tax. By understanding the nature and limitations of the rental income exemption, landlords can better assess the valuation potential of the B&O tax when selected for an audit by the Washington Department of Revenue. To determine the tax liability of the different uses of real estate, you need to know the difference between leasing or leasing real estate and a license to use real estate. But new revenue opportunities bring new tax implications.

Like hotel and B&B stays, short-term rentals in Washington State are also subject to the tax. The tax authorities require guests of short-term holiday apartments to collect the applicable short-term rental taxes from their customers and transfer them to the competent authorities. Commercial real estate leases often create another burden for B&O taxes. Commercial leases typically come on a “triple-net” basis, which requires tenants to reimburse the landlord for various expenses associated with the property, such as utilities, property taxes, insurance, and common area maintenance costs. Although utility refunds are explicitly exempt from B&O tax under Washington`s administrative rule, reimbursement of other expenses could potentially be considered related to, but not derived from, and therefore subject to B&O tax. Many commercial real estate leases in Washington describe these fees as “extra rent,” but it`s unclear whether this labeling is enough to exempt them from tax. Business owners also often receive income from the sale of parking and garage services, which may be subject to both B&O sales tax and retail sales tax. The location of your rental is crucial information for compliance with the short-term rental tax. Your address determines the tax jurisdictions to which you must declare, the taxes you must levy and the tax rates you must levy. For example, let`s say you invest in a rental property that you can rent for $1,000 a month, for example.

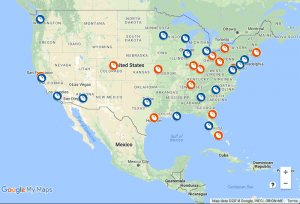

This means you`ll have $12,000 in your bank account by the end of the year if you manage to keep your home occupied. It`s clear that owning a rental property in Washington can be lucrative. That is, as with any other type of investment, it is not without risks. So make sure you do as much due diligence as possible before investing. And this is due to the rise in real estate prices. According to various online sources, home equity is expected to rise rapidly later in 2021. This is obviously good news for rental real estate investors, as the high cost of homeownership will lead to increased demand for rental properties. Avalara MyLodgeTax has developed this guide to help you comply with Washington State`s short-term rental tax laws. For more information on the tax rates and jurisdictions that apply to the specific location of your accommodation, use our accommodation tax search tool.

@Marcia Maynard, the commercial side is always the same, not the rent taxes. As with any other business, owning a rental property also means you have full control over how it goes. You can decide what type of tenant you want to rent to. How much rent to charge each month. What upgrades to perform. And how long a tenant is allowed to stay there. I offered short-term rentals without charging the accommodation fee. What are my options? Short-term owners in Washington State may be able to use a Voluntary Disclosure Agreement (VDA). A VDA offers hosts the ability to proactively disclose tax obligations from the previous period in accordance with a binding agreement with the Washington State Department of Revenue. VDAs are proposed to encourage cooperation with state tax laws and may result in a waiver of some or all penalties and interest payments.

This is perhaps the main reason to buy a rental property. If you own a rental property, you will be ready to earn a stable passive income for many years to come. There are situations where you don`t have to collect accommodation taxes in Washington State. For example, a customer who rents long-term rather than short-term is exempt from the short-term accommodation tax. I don`t deal with commercial real estate, but for residential real estate, there is no state tax on rental income in Washington State. However, rental income would be reported on the federal income tax return in accordance with Schedule E. It is the landlord who pays the tax, not the tenant. And that`s a very modest rental amount. In fact, the current median price of rent for an apartment in Washington State is $2,160. That`s enough to cover mortgage payments, depending on how much you spend on a property.

Rentals or rentals of real estate are not subject to B&O tax or retail sales tax. However, income from the provision of a license to use real estate is subject to the B&O tax. But how do you distinguish them from each other? Here are some general guidelines: Before collecting short-term rental taxes from your guests, you need to know if any taxes have ever been levied on you. Some vacation rental markets charge short-term rental taxes in Washington State for you when the offer is booked. If taxes are not levied on your behalf, you are responsible for collecting and paying them to the state tax authorities. Check with your market for the latest information about the taxes they collect on your behalf. Yes. Many short-term rental hosts in Washington State file multiple state and local tax returns each year. For many, connection solutions like MyLodgeTax can reduce this burden. When you start operating a short-term rental, although you may not have experience with accommodation taxes, you are probably familiar with income tax.

It is important to understand the difference between the two. No short-term tax guide for holiday apartments replaces professional tax advice. Think of this as an enrichment that will help you understand and prioritize your vacation rental questions and concerns. Questions about specific situations or exceptional conditions are best resolved with a certified tax professional who is familiar with Washington State tax laws. More and more Washingtoners, just like others in the country, are choosing to rent a house instead of owning it. As a result, the demand for rental properties is increasing in various cities in the state. Whether you choose to offer short-term rentals through a marketplace like Airbnb or directly to the consumer, you open the door to tax liability at the national and local levels. Because tax revenues are a major source of local funding, tax authorities are becoming increasingly aggressive in their efforts to identify individuals and businesses that do not comply with tax laws. Failure to register with tax authorities in a timely manner and fail to file short-term rental tax returns in Washington State can result in late fees, interest payments, and, in extreme cases, lawsuits. As a member, it is your responsibility to know the guidelines of the association. It is important to read this information to understand any restrictions or restrictions on short-term vacation rentals.

In our experience, there are significant differences within the Audit Division of the Washington Department of Revenue in the care with which sources of additional revenue associated with real property leasing are examined as part of the audit and in the resulting audit assessments. While some audits of property owners continue to run smoothly, landlords should recognize the potential risk in this area, especially given the state`s persistent fiscal problems. Before you can start collecting short-term rental taxes, you need to know the right rate. Prices can change frequently, so it`s important to make sure you have the latest price to avoid charging your customers too much or too little and running into compliance issues. In Washington State, depending on your location, different accommodation taxes may apply to your short-term rental. These may include: Before you can start collecting taxes on your short-term rent in Washington State, you must legally register with the Washington State Department of Revenue. You`ll need to register with the state for tax purposes if you operate a short-term rental three or more times a year. .